However, businesses lacking inventory should be fine using the cash-basis accounting approach. Cash accounting makes this problematic as it focuses on the flow of money rather than tracking the movement of inventoried goods. Businesses operating without inventory: Companies need to account for their inventory at the opening and closing of the tax year.Additionally, their earnings tend to be well below the $25 million per annum restriction, making this system unavailable for income tax calculations. Sole proprietors and small businesses: These businesses are more likely to use cash-basis accounting, as it is straightforward and easy to use.When To Use Cash-Basis AccountingĬertain types of businesses can get the most out of this form of accounting. Knowing exactly how much cash is available helps determine when bills get paid or how quickly. For newer or very small businesses, staying profitable is of great concern. This system focuses on cash flow, with a particular emphasis on cash on hand.

#Www quickbooks online software#

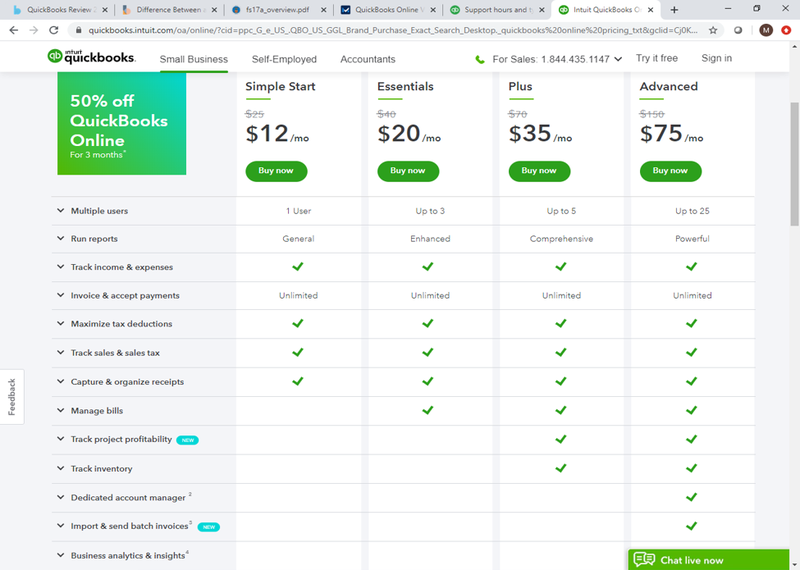

This article explores how cash and accrual accounting work, their benefits and disadvantages, the best software tools for each option and which accounting method works best for what types of businesses.Ĭash-basis accounting is also known as cash receipts and disbursements or the cash method of accounting. That is important, as receiving or sending payment is not always immediate. However, the accrual method accounts for earnings the moment they are owed to you and expenses the moment you owe them it does not matter when your money enters or leaves your account. Cash-basis accounting documents earnings when you receive them and expenses when you pay them. The key difference between the two approaches is timing. Accrual-Basis Accounting: This approach tracks whenever an action results in earnings or accrues an expense.Cash-Basis Accounting: This method focuses on your business’s cash flow, tracking money that comes in as revenue or goes out as expenses paid.For instance, certain businesses cannot use cash-basis accounting because of the Tax Reform Act of 1986.Ĭhoosing the right accounting method requires understanding their core differences. You will need to determine the best bookkeeping methods and ensure your business model meets government requirements. Yet, depending on your business model, one approach may be preferable. Cash-basis or accrual-basis accounting are the most common methods for keeping track of revenue and expenses.

0 kommentar(er)

0 kommentar(er)